This Southwest Detroit nonprofit program helps renters become homeowners

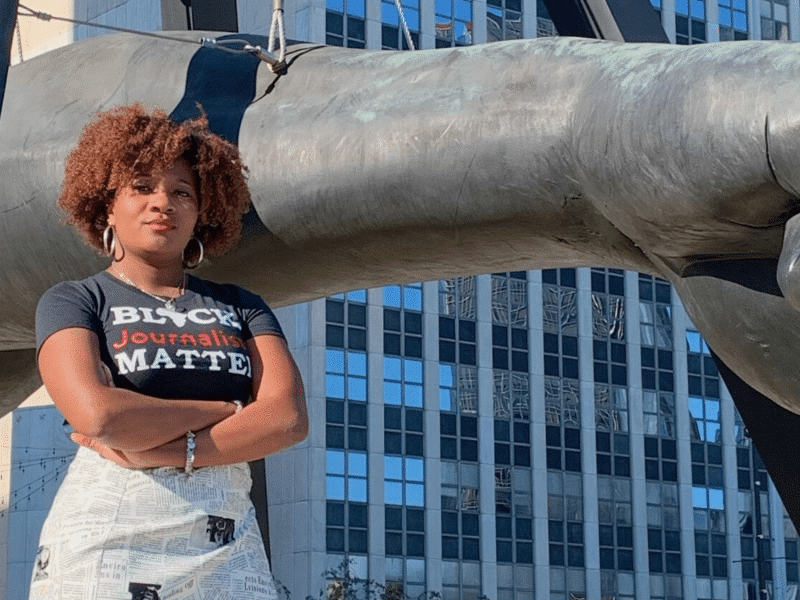

Detroiter Leslie Jackson's path to homeownership was made possible through an innovative initiative sponsored by the Detroit-based nonprofit Southwest Housing Solutions.

This past week has been a wonderful time for Detroiter Leslie Jackson. After a lifetime of being a renter, the mother of three now finally owns her own home. Jackson and her family finished moving into their new residence this last weekend. Their new place is a tan-colored four-bedroom house on 29th Street in Southwest Detroit’s Chadsey-Condon neighborhood. And for Jackson, it’s a perfect fit.

“It is absolutely phenomenal. It is literally exactly what we wanted,” she says. “Everybody’s able to have their own room. I have my own office. I’m going to have this big old giant backyard because we have a dog, So she’s definitely going to be out there running.”

Although Jackson is still getting adjusted to her new surroundings, she’s looking forward to meeting her neighbors (in a COVID-conscious way) and prettying the place up with flower gardens when the weather gets a little warmer.

Her family’s path to homeownership was made possible through an innovative initiative sponsored by the Detroit-based nonprofit Southwest Housing Solutions. The Newberry affordable homeownership program, as it’s known, offers renters an opportunity to become homeowners through a series of payments that can be equal to or below their current level of rent.

Right now, Jackson works at an insurance company and runs her own soap-making business, Bonheur Bath House. While she always dreamed of owning her own home, making that happen proved to be more difficult than she had hoped. Over the last two years, she tried several times to get a mortgage from a bank, but found that being both a business owner and a W-2 employee created obstacles.

“They either want you to be 100 percent W-2 or 100 percent 1099,” she says. “And I’m always a combination of the two, so even though I was in a monetary situation to manage and be responsible for a mortgage, I just couldn’t get it through conventional means.”

Renter to Owner

Fortunately, Jackson was eventually able to work something out with the help of Southwest Housing Solutions Newberry program.

The initiative is aimed at promoting homeownership in Southwest Detroit’s Chadsey-Condon neighborhood. The Newberry community where the program gets its name from is made up of 60 homes located in an eight-block area located between Michigan Avenue, Buchanan Street, 28th Street and 32nd Street.The colonial-style homes there are vinyl-clad, two-story residences that range between 1,200 to 1,400-square-feet. And each of them comes with three to four bedrooms and two bathrooms. All the homes there were built in 2002 by a developer that had been using Low-Income Housing Tax Credits (LIHTC) to provide affordable rental housing to low to moderate income families.

Southwest Housing Solutions bought the Newberry homes from the previous developer in 2017. That was just about the time that the tax credits there were expiring. So rather than continue to rent, it opted for an alternative: offering up a pathway to homeownership.

“We’re pretty excited about what’s happening there,” says Dan Pederson, director of business development for Southwest Housing Solutions. “What we do is we sell the house to folks that were renting before. They are getting what’s called a soft second mortgage.”

Soft second mortgages are loans that are used to pay the down payments and closing costs needed to buy a home. And often, as is the case with the Newberry program, those loans are forgivable after a certain period of time.

The purchase price for a Newberry home currently comes in at $62,000. But as a result of a $2.5 million grant from the Sam L. and Judith G. Yaker Fund, up to $20,000 in downpayment assistance is available to homebuyers who qualify for the program as a conditional grant. That grant is forgiven once a homeowner has lived at home for five years, a measure taken to keep house flippers from taking advantage of the program.

To qualify for the initiative, a prospective buyer must not own another home and have an income of 60 percent AMI or less, that’s an income of about $47,000 or less a year for a four-person household.

Those who participate must take a homebuyer class and may have to work with a financial counselor to bring up their homebuyer’s credit score. Both the class and financial counseling are free to those in the program (and are also available to the general public). Once a person qualifies, they sign a 15-year mortgage. The new homeowners monthly payments include taxes and insurance for the property and can often be less than what they were paying as renters.

Jackson, who previously rented from a Southwest Housing Solutions at an apartment

complex close to her current home, appreciates the support she’s received from the nonprofit as she endeavored to buy her new home.

“They have been very helpful. I used every single [service] that was available to me, and they welcomed it,” she says. “It took a little while, but I guess what they say is true: good things come to those who wait.”

Expanding Boundaries

The Newberry Program is far from the only project keeping Southwest Housing Solutions busy right now.

In fact, the real-estate-oriented nonprofit is just one in a family of organizations carrying out a variety of missions under the Southwest Solutions banner. In addition to Southwest Housing Solutions, there’s also Southwest Counseling Solutions, which offers mental health services as well as supportive housing to transitionally homeless people; Southwest Economic Solutions, which specializes in programming around financial literacy, homebuyer education, foreclosure prevention and workforce development; and Southwest Solutions, the parent corporation to the other nonprofits.

Founded in 1970 by Monsignor Clement Kern, former pastor of Detroit’s Most Holy Trinity Catholic Church, Southwest Solutions originally focused its efforts on mental health services like psychiatric and medication assistance. Southwest Housing Solutions was established in 1979 and initially concentrated on providing a few dozen living units neighborhood residents facing homelessness and mental illness. In 1996, however, the housing nonprofit expanded that mission, embracing a broader community development approach focused around affordable housing.

“We started our community development work with a very specific focus on the acquisition and rehabilitation of abandoned buildings,” says Tim Thorland, Southwest Housing Solutions Executive Director. “We surmised from a community development perspective. that new construction or other innovative type programming wasn’t going to be all that effective in these neighborhoods with the quantity of blight that you had on the landscape.”

With that in mind, the nonprofit focused on rehabbing older buildings and making use of federal funding through Low-Income Housing Tax Credits and HUD’s HOME program to offer quality affordable housing to local families.

Today Southwest Housing Solutions owns about 715 affordable housing units, including 26 multi-story buildings used for both residential and retail purposes. It’s now the largest multi-family developer in Southwest Detroit, with roughly 450 units in the neighborhoods of Springwells and Hubbard, and others in the Hubbard-Richard and Chadsey-Condon neighborhoods.

Over the last decade, the nonprofit has also ventured beyond its traditional Southwest Detroit boundaries and started to engage in new construction. In 2010, it opened a 150-unit complex in New Center for formerly homeless veterans called Piquette Square.

Three years later, it held a grand opening for the Mack-Ashland mixed-use project on the city’s East Side. A collaboration between Southwest Solutions, Warren/Conner Development Coalition, U-SNAP-BAC, and other partners, the $8 million project offers 39 units of supportive housing and 6,000 feet of commercial space.

And two years ago, it teamed up with Lighthouse of Oakland County and South Oakland Shelter on a $15 million project that now offers 64 townhomes and ranch-style apartments to lower-income families in Oak Park.

Like these initiatives, the Newberry program is also something new for Southwest Housing Solutions. In the past, encouraging homeownership has been something that’s mostly happened on a case-by-case basis. The nonprofit’s work with Newberry in Chadsey-Condon marks the start of a more holistic strategy that involves providing services and offering high-quality housing and options, while also providing an avenue for residents to accrue wealth by investing in a home.

“It’s a step forward in the evolution of our work,” says Thorland. “It’s much more about providing comprehensive solutions that improve quality of life and not just addressing a single issue or component that might be a challenge to a household or family.”

Investing in Community

Like Jackson, Katrina Johnson and her husband Delawn Ross are former renters who bought their family home through the Newberry program.

The couple has lived in their four-bedroom home on 32nd Street since 2001, when it was newly built and raised their four sons there. Johnson, who works at Sinai-Grace Hospital in Detroit has wanted to be a homeowner since she first moved in and learned that long-time occupants would eventually have an opportunity to buy the property for themselves.

After 18 years of renting, the couple finally bought their home 2019. To do so, Johnson had to raise her credit score. Working with financial coaches from Southwest Solutions, she was able to lift her score by 150 and sign a mortgage to her home. In addition to that, she later bought three lots adjacent to her home. And as a new homeowner, she’s taking advantage of her new freedom to improve both her house and the surrounding property.

“I’m able to do remodeling,” she says. “I did a patio this past summer. We did gardening. I was able to paint the walls in different colors and put new carpet down. It’s a great feeling!”

Overall, living in the home has been really pleasant for Johnson and her family, but they did run into an unanticipated problem when a fire broke out on their first-floor bathroom this January. Thankfully, the fire department came in time to save their home. Although the bathroom was affected and there was some water damage, the home turned out alright, because she was insured, a cost that’s included in the payments to buy a Newberry Home.

Johnson is just one of many new homeowners in Newberry. As of March 5, 34 families have bought homes through the Newberry program, while 26 are still renters. Meanwhile, Southwest Housing Solutions continues to reach out to renters to assess their interest in purchasing the homes they’re living in.

As manager of the Newberry Program, Pederson has enjoyed watching renters make the transition to homeowners and is hopeful about the impact it will have on the local community.

“We’re really excited about … the impact that the homeowners are going to have,” he says. “They’re excited to be an owner. They’re excited to take care of their own property. They’re excited to see their block prosper.”

Correction: An earlier version of this article listed the price of a Newberry home at $59,000. The current price is actually $62,000. It also mentioned Newberry homes could only be purchased by renters who had lived at Newberry or another Southwest Housing Solutions unit. While renters take priority in the purchasing process, houses may also be available for sale to others who do not currently own a home.

Resilient Neighborhoods is a reporting and engagement series that examines how Detroit residents and community development organizations are working together to strengthen local neighborhoods. It’s made possible with funding from the Kresge Foundation.