Black Detroit developers reveal secrets to successfully scaling up operations

"Building a strong network, it just can’t be overemphasized, but it also has to be done with intention," says Elizabeth Luther, Capital Impact's Detroit program director. Newer developers often face many obstacles as they step up to bigger projects. Here's a look at some local developers who have made the leap and the lessons they've learned.

After nearly a decade on the Detroit-area real estate scene, Ponce Clay has his mind set on stepping up his development efforts.

Born and raised in Detroit, Clay wears a lot of hats. Aside from his real estate work, he’s a practicing attorney and retired Naval officer who holds a Masters of Business Administration from the University of Detroit Mercy. The multi-faceted businessman and professional got his start as a developer back in 2013, initially buying properties from private sellers, auctions, and land banks and fixing them up to sell at a profit.

Clay has always been fascinated by people who use their hands to create the structures where people live, work, and congregate. Inspired by that sentiment and the new wave of development he was observing around Detroit in the early 2010s, he decided to get involved in the industry himself, which led to him founding the Clay Realty, Investment & Development Co.

“In my community, I saw opportunities and thought ‘Maybe I can give it a shot,'” he says. “I’m not a building [trades] person, but I can use my skill set to orchestrate and bring the tools together in order to do something. I got interested in it as an opportunity to serve the community and at the same time build my business.”

At the moment, Clay is focusing his attention on a group of properties he owns in Detroit and Highland Park. This time around, though, he’s interested in doing something more impactful than simply fixing up and selling homes.

In Highland Park, he’s looking into renovating a property at 11805 Hamilton Avenue

for commercial use, possibly a mix of office and retail space. Clay also owns a strip of open land in Detroit near Dexter and Calvert Avenues. He’s currently considering building a new mixed-use facility there, likely a combination of living units and light retail.

For Clay, scaling up his operation is about more than just bringing in more revenue and growing his real estate portfolio. The Detroit-based developer is also interested in the challenge of learning new skills and participating in local revitalization efforts in a way that takes into account the expressed desires of local community members.

As these projects are bigger than anything the Detroit-based developer has worked on in the past, he’s also exploring the possibility of taking on partners for these new ventures. While that might cut into potential profits, it also carries advantages like spreading out risks and bringing more expertise and connections to the projects. And doing so may offer Clay the opportunity to make a more realized contribution to the local urban landscape than he’s done in the past.

“I’ve learned the lessons of the past 10 years: how to acquire, how to protect, how to sustain, how to activate [properties],” he says. “Now I want to move beyond my comfort zone to actually create.”

Taking advantage of local resources

Making that kind of leap isn’t the easiest thing to do for developers like Clay, whose prior development experience has primarily focused on smaller-scale projects.

And those who are newer to the industry, especially developers of color, often face numerous hurdles that can hamper their ability to take on larger endeavors, foremost of which are difficulty obtaining capital, the absence of a proven track record with bigger projects, and a lack of institutional access. However, local resources are available to help Detroit-area developers make that transition.

One organization that’s been garnering a lot of attention for doing this sort of work in recent years is Building Community Value (BCV), a nonprofit dedicated to implementing and facilitating real estate development projects in under-resourced Detroit neighborhoods. It offers a program called Better Buildings, Better Blocks that’s geared towards giving new and small-scale developers the tools they need to grow and prosper.

Monique Becker, BCV’s Manager of Program Implementation, describes the course as a comprehensive entry-level overview of community-focused development work.

“We teach folks the fundamentals of real estate development,” she says. “How to buy right, how to approach a project, how to do design, and construction, and interact with developers. We show folks how to prepare for their first lender meeting and bring their concept to fruition.”

Becker, a graduate of BCV’s program herself, is also the co-owner of a real estate, development, and construction firm called Mona Lisa Living. Founded in 2019 with business partner Elyse Wolf, the company is known for its artful renovations of Detroit buildings like Hazelwood Home in Virginia Park and The Lin in LaSalle Gardens. More recently, Mona Lisa Living has begun branching out to include larger development projects in northern Michigan connected to the tourist and hospitality industries.

Becker is a big believer in collaboration, and being able to network and find common ground with others in and out of the development sphere has really allowed her business to blossom. It’s something, in addition to teaching important skills, that she believes is an important resource BCV offers to its participants.

“I’ve partnered with folks who maybe wouldn’t be in that development space otherwise,” she says. And that’s also what kind of keeps my passion and connection to BCV as well. Because it’s really important to have the residents who are passionate about improving their communities have the skills to be able to do so.”

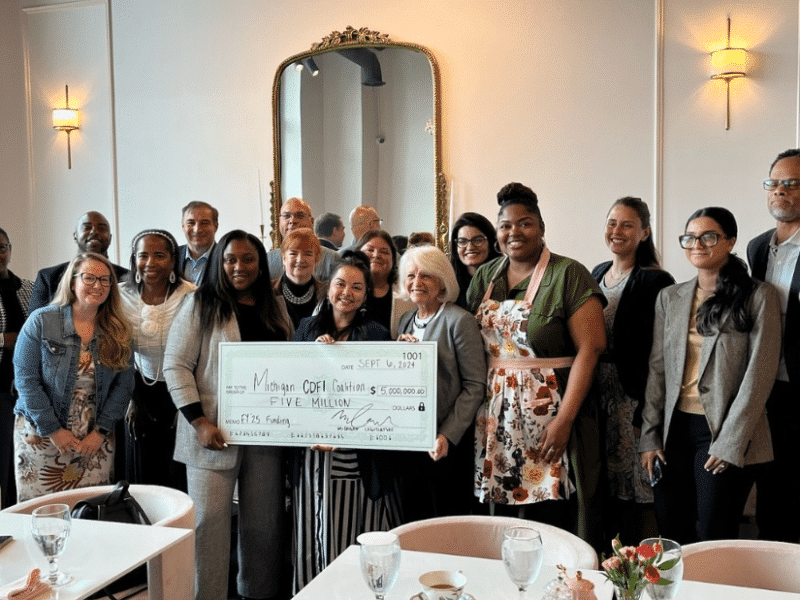

For somewhat more experienced developers, Capital Impact Partners also offers a variety of tools to help them level up their real estate efforts. It’s a community development financial institution (CDFI), affiliated with the Momentus Capital family of companies, that’s taken an active role in assisting Detroit developers.

Troubled by the fact that of the $152 million that Capital Impact lent in Detroit between 2006 and 2015, only 9% went to projects led by minority developers, the CDFI in 2017 launched a program called the Equitable Development Initiative (EDI).

“EDI works to support real estate developers of color seeking to own and develop property, provide quality mixed-income housing, and stabilize disinvested neighborhoods,” says Elizabeth Luther, Capital Impact’s Detroit program director.

Established with pilot funding from JP Morgan Chase, the program is also dedicated to making sure Detroit residents are involved in the redevelopment of their communities.

EDI sponsors a cohort-based Learning Series training program that prepares participants with the knowledge to lead a mixed-use development projects in the local market. It’s focused on helping cohort members establish a strong network of fellow development professionals and municipal and community partners, develop financial modeling fluency, and gain an understanding of how to build a business and wealth through real estate development. Participants also get one-on-one technical assistance from program advisors and mentors to support their real estate efforts, as well as capital tools, including pre-development grants and referrals to other capital sources.

Roughly 200 emerging developers of color have participated in or are being trained through the EDI program, which boasts more than 100 alumni from its five cohorts. The success of the program in Detroit has also led to its expansion in Washington, D.C., the San Francisco Bay Area, and Dallas.

In addition to EDI, Momentus Capital also recently launched a credit-blind financing initiative called Activate Detroit, which was established to help empower Black entrepreneurs.

“As of early August, we had provided over $1.1 million in funding to 20 Activate Detroit loans in metro Detroit since the program launched just under a year ago,” says Luther.

Clay is a graduate of both BCV’s and Capital Impacts programs and credits them with helping him to better understand the planning and process of development work and how it can be used to serve local communities. Beyond that, his association with the two organizations has also connected him with a deep network of allies and potential partners.

“Prior to EDI and Building Community Value, I did not even know where to start,” he says. “[They’ve given me] the tools to be able to access and plan the mechanics of a “successful development” that’s not driven by emotion [but] by facts and analysis.”

Developing with the community in mind

Edward Carrington of the Flux City development firm is also a graduate of the BCV and Capital Impact programs. Like Clay, he’s been a Detroit-area developer for about a decade now, focusing mostly on single-family properties in and around the city. The Flux City development firm is built around the idea that development

should assume that change is normal and emphasize qualities like adaptability, resilience, and flexibility.

“I came up with the ‘Flux City” concept while overlooking the Detroit river from the Belle Isle bridge, and was basically caught in a trance by the singular body of water that connects Detroit and Windsor being in constant transformation and “flux”, but in a beautiful, harmonious way,” says Carrington. “Having the ability to adapt to a given environment/community/need is what I feel that most physical space doesn’t usually do a good job at. Flux City wants to be the exception.”

Carrington credits BCV’s program with helping him better understand the inner workings of small-scale real estate development as well as giving him insight into what projects to take on, financing opportunities, and project management for community-driven projects. As for Capital Impact’s program, it gave him greater exposure to sound development practices and introduced him to numerous local Black and brown developers.

“Having the opportunity to take part in the Better Buildings, Better Blocks training (Building Community Value) and the Equitable Development Initiative (Capital Impact) gave me the knowledge, tools, and confidence needed to scale up to larger projects,” says Carrington.

At the moment, Flux City is working on a larger-scale project called “The Ribbon”.

Located in East English village, the development involves redeveloping a one-story, 5,760-square-foot former Charter One bank there into a three-story mixed-use building. When it’s completed, The Ribbon will feature a ground-floor restaurant and two residential floors with 18 residential units priced between 50% and 80% AMI.

Embracing the ideas of flux and flexibility, the new development will be built with resident access to the first-floor retail space and connections between its building, patio, and a related streetscape. Construction on the project is slated to begin this fall and wrap up in around 18 months.

One of the biggest challenges with getting The Ribbon off the ground involved convincing contractors and funders that Flux City could handle large-scale projects. Ultimately, however, Carrington was able to gain their trust in the development, which he expects to be very popular with local community members.

“Flux City’s strategy from the beginning was to make sure the community is heard as we design The Ribbon with a ground-up approach that focuses primarily on enhancing the streetscape with demanded retail options for the local residents,” he says. “This is why we held a number of community engagement events to make sure that we gained input from the residents who walk, bike, and drive the neighborhood blocks on a daily basis.”

Building on a firm foundation

What else should small-scale developers keep in mind as they work to scale up their real estate efforts? While understanding the fundamentals of real estate development is a must, Luther stresses the importance of building strong, focused networks.

“Development is so complicated,” she says. “You need to interact with so many different types of professionals, architects, engineers, municipal representatives, and lenders. Building a strong network, it just can’t be overemphasized, but it also has to be done with intention. Network building for network building’s sake will only get you so far.”

As for Becker, she firmly believes in the importance of solid planning.

“I think the biggest thing is just being realistic,” she says. “A lot of times, people romanticize the process and think they can scale up to step three when they’re at zero. You really do have to take an incremental approach. Finding the beauty and the lessons to be learned in smaller deals will over time help you to grow.”

Photos by Nick Hagen, unless otherwise noted.

This is part of the Block by Block series supported by FHLBank Indianapolis that follows minority-driven development in Detroit.