Partner Partner Content Federal Home Loan Bank of Indianapolis is helping Detroiters tackle much-needed home repairs

This sought-after program is helping Detroiters get the funds they need to make pressing repairs to their homes.

For the majority of homeowners, rain is a minor inconvenience. For Detroiter Kenny Tanner, rain was a major problem that found him placing buckets and pails throughout his home on Mount Vernon Street.

In August, the retired laborer received what he calls a “blessing” in the form of a new roof paid for through a home repair grant from the Federal Home Loan Bank of Indianapolis’ Neighborhood Impact Program.

“There’s no more leaks when it rains, so I don’t have to worry about it,” Tanner says. “That morning when I heard the water dripping on my living room sofa, I thought the squirrels did the damage.”

Tanner, who lives on a fixed income, says the 93-year-old home he purchased in 2007 is the oldest in his east side neighborhood. He wants to make sure that it looks as appealing as neighboring properties, but lack of financial resources kept him from making needed repairs, the most immediate being the leaky roof.

“It’s a true blessing,” he says of the FHLBank Indianapolis home repair grant, “especially for low-income people like me who don’t have the funding to make the repairs themselves.”

Meeting a need for Detroit homeowners

FHLBank Indianapolis, which is part of the Federal Home Loan Bank System, developed its home repair grant program in 2005 based on the increasing needs of low-income residents in Michigan and Indiana that were becoming more and more visible, says Rori Chaney, Community Investment Department Manager at FHLBank Indianapolis. Chaney’s department oversees the program, which makes grants available to assist qualified homeowners with deferred maintenance repairs.

Since 1990, FHLBank Indianapolis has annually contributed 10% of its earnings to support affordable housing initiatives in Michigan and Indiana. The bank is a regional cooperative, which means it is owned by its member banks, credit unions, and other financial institutions in Indiana and Michigan. Each year, these organizations apply for, and many receive, funding to help finance the building of their affordable housing developments. Sixty-five percent of those dollars fund larger affordable housing development projects, which awards grants of up to $500,000, and the remaining 35% is designated for a homeownership grant program that supports the entire cycle of homeownership for low-income families.

To qualify for the bank’s home repair grants, the total household income has to be below 80% of the Area Median Income which is $64,960 for a four-person household in Wayne County, according to Fannie Mae. Chaney says the program is designed to serve moderate to low-income families.

“What we see a lot of are elderly individuals on a fixed income,” he says.

These homeownership grants fall into three broad categories: down payment assistance for new homeowners, modifications to improve accessibility for seniors or people with disabilities, and support for critical repair needs for homeowners like Kenny Tanner. This year, there was a total of $3.7 million available for residents in Michigan and Indiana.

Tanner received the maximum home repair grant of $7,500 and was among 600 households that were served during the 2021 grant-making cycle.

Grants are allocated on a first-come, first-served basis, and this year’s grant funds ran out within 30 days of being made available. Compared to last year, where there was a total of $7 million available funds which lasted for 60 days, there was a much tighter window for processing these homeowner’s applications. This required cooperation and coordination on the part of several different partner organizations.

Local Partnerships Facilitate Funds

Homeowners who qualify for a home repair grant connect with community organizations that work with a local bank, credit union, insurance company, or community development financial institution that is a member of FHLBank Indianapolis. It’s through these member financial institutions that homeowners can apply for the home repair grants. On average, between 60 and 70 of FHLBank Indianapolis member financial institutions participate in programs offered by the bank that are designed to get people on a homeownership track or keep them in their homes.

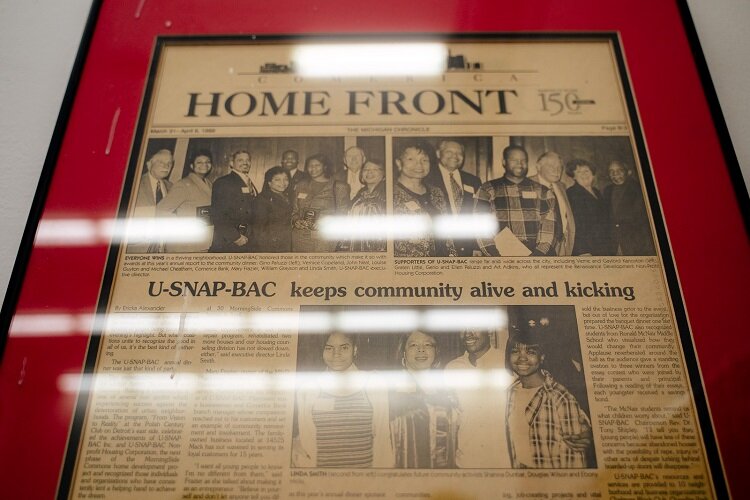

“Staff at our member institutions are really engaged in the community and are connecting to non-profit organizations to make sure these dollars get to community residents,” Chaney says. “Organizations like U-SNAP-BAC that have been rooted in Detroit’s east side community for decades are able to provide services above and beyond our programs.”

FHLBank Indianapolis doesn’t market the program directly to homeowners, but instead spends much of the year educating the member financial institutions and non-profit partners about the programs.

“We don’t go directly to the residents in need, and they don’t typically know who we are. Sometimes they don’t even know it’s our money or that we’re involved,” Chaney says. “We can only work with our members and housing agencies that have formed partnerships with our members. Our members are the conduit of our funds and of our funds getting to the streets.”

Tanner’s grant was the result of a collaboration between FHLBank Indianapolis member First Independence Bank in Detroit, U-SNAP-BAC, and supported by Fifth Third Bank.

After submitting an application and receiving approval, FHLBank Indianapolis provides the grant funding to the member financial institution for disbursement. The first half of the payment is issued to the contractor doing the repair work with the balance paid after the job is completed.

Linda Smith, Executive Director for U-SNAP-BAC, says she and her staff must see the finished repair work before a contractor receives that final payment. Those who receive the grants are responsible for finding a contractor and must submit two different bids for the needed repair(s).

For the home repair grant that Tanner is using, the funds have to be used to replace existing components of a home.

“You can’t get siding if you don’t already have siding,” Smith says.

Although the replacement of things like existing doors, windows, siding, and HVAC (Heating, Ventilation, and Air Conditioning) systems are all eligible for grant funds, roofs represent the most common use of the funds.

“Over the years, we’ve worked with the FHLBank Indianapolis to streamline the process and explain to people that this is what the grant does and does not do,” Smith says.

Although U-SNAP-BAC has been involved with the home repair grant program for 15 or 16 years, it wasn’t until about three years ago that Fifth Third and First Independence banks began working directly with Smith and her team on the program.

“Prior to this we had a team of folks do the legwork that Linda’s organization does now to pull the grant applications together,” Jason Paulateer, Senior Vice President and Community and Economic Development Market Manager at Fifth Third Bank says. “We brought Linda into the partnership and provided funding to her organization to serve as the backroom operations. U-SNAP-BAC builds a pile of potential applicants. Ahead of the grant round of applications and prior to the opening of grant applications, they will solicit and administer the grant applications from their residents.”

Through organizations like U-SNAP-BAC, Detroit homeowners have a local connection and resource to better facilitate access to home repair funds from a bank with a regional footprint.

Getting it done

Families began coming to U-SNAP-BAC in April to pick up applications for their 2021 home repair grant program. Smith says 25 of those applications were approved and funded before the pool of funds allocated for her area of focus in Detroit ran out. That area covers the Morningside neighborhood on the city’s east side which is populated with rentals and single-family homes.

She says the allocation of the funds depends on where the bank’s focus is for a particular area. “It could be a particular zip code or neighborhood, but we also take applications for anywhere in the city,” Smith says.

The application submission process began on May 3, and by June 7 the funds had all been allocated, Chaney says. “Our members would say that the funds go way too fast,” he says. “We limit our members so they can’t monopolize the program or all of the money.”

In addition to collecting the grant applications, Smith and her staff host workshops for homeowners who qualify and want to learn more about the home repair grant program so they can be better prepared to fill out their paperwork and submit their application as soon as that part of the process opens up. She says the number of people filling out applications far exceeds those that receive the grant funds.

If those applications aren’t filled out correctly, they go back to the homeowner for additional information which puts them behind other applicants who submit a complete application. This can cost them the opportunity to get a grant in the same year they apply for it.

“In 2019, we had 534 people line up at our office on the first day, so they could pick up applications. Typically, we have 300,” Smith says. “That day, we had so many people that I told the staff, ‘We’re not going to stop until everyone has an application.’ We let them into the office 25 at a time and I stood outside and talked to the people in line about what they needed to have such as proof that they own their own home and a recorded deed older than six-months-old.”

In 2020, U-SNAP-BAC was technically closed because of COVID, but Smith says she emailed 30 people who were in the queue in 2019 when the money ran out. Those people brought their information to the office and she was able to assist them.

“We don’t do a waiting list,” Smith says. “People come by in April and pick up an application. Families who return the complete application back in get to move into having it processed.”

Tanner says he thinks he began applying for a home repair grant three years ago.

“So many other people had applied and the funding had run out. I needed a new roof bad,” he says. “It seems like I had been waiting forever. Miss Smith came down and took a look and said, ‘Oh, you need a grant.’”

The home repair grants are critical, Chaney says.

“Unless you’re in that situation or it’s your family member living like that, most people have no idea,” he says. “The demand is so much greater than the supply of funds out there. For the 600 households who received grants this year, there are more than 600 households that have to find another solution.”

All photos by Nick Hagen.

This is part of the Block by Block series, supported by FHLBank Indianapolis, that follows minority-driven development in Detroit.