Detroit Capital Hub connects entrepreneurs, small businesses with Detroit CFDI lenders

A new private-partnership between the Detroit Economic Growth Corporation (DEGC) and the City of Detroit — Detroit Capital Hub — serves as a matching program introducing small businesses to the lender best able to serve them.

Block by Block is a solutions journalism series that is supported by IFF, CEDAM and Invest Detroit, and is focused on community development leaders and initiatives in Michigan, Ohio and Indiana.

Most entrepreneurs at the start-up phase or early days of the business are juggling many hard tasks alone, often responsible for being the owner, operator, sole funder, manager, social media manager, IT person, and other strenuous roles. They know they need help, but don’t know where to start looking for help.

A new private-partnership between the Detroit Economic Growth Corporation (DEGC) and the City of Detroit serves as a matching program introducing small businesses to the lender best able to serve them.

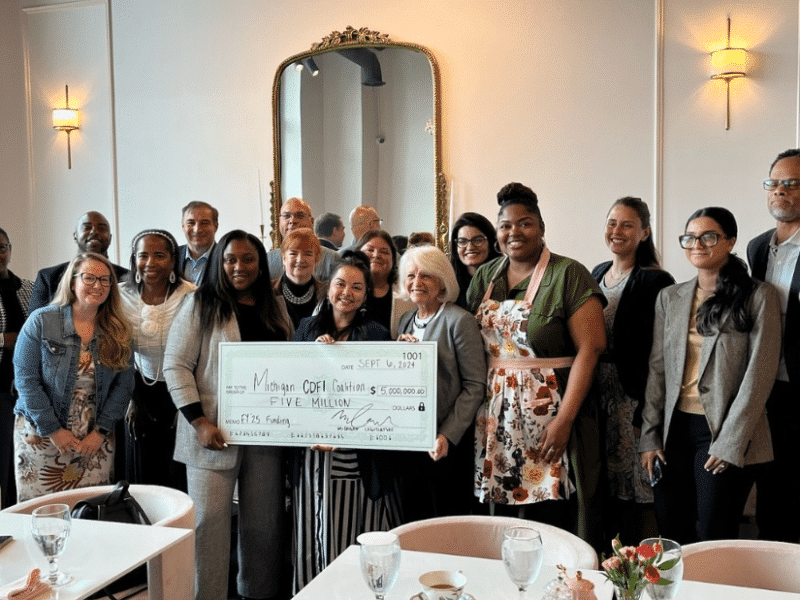

Launched in September, Detroit Capital Hub is an innovative online platform helping to connect Detroit entrepreneurs and small business owners with local Community Development Financial Institutions (CDFIs).

Together, Michigan CFDIs including Invest Detroit, ProsperUs, Opportunity Resource Fund, Michigan Women Forward and Detroit Development Fund provide more than $5 million in loans each year. Made possible with funding by the Gilbert Family Foundation and Ally Foundation, Detroit Capital Hub is poised to become a centralized resource for entrepreneurs.

Justin Onwenu is the Director of Entrepreneurship and Economic Opportunity at the City of Detroit. His role is designed to help execute on the Mayor’s small business and start-up agenda.

“That agenda includes working with DEGC to create and sustain programs that support entrepreneurs, whether they be high-tech startups or traditional brick and mortar, neighborhood businesses as well — with particular focus on increasing access to capital for Detroit entrepreneurs,” Onwenu says.

Detroit Capital Hub was designed as a solution for a need expressed by the small business community, says Onwenu.

“There are a lot of entrepreneurs who have really great ideas, great operational sense, but they literally just don’t have the connections and relationships to know how to go about forming banking and CDFI-based relationships,” he says.

“We’ve heard from a lot of entrepreneurs that oftentimes, the biggest barrier to accessing capital is just knowledge and connection,” he says. “This idea really was a way to make it easier for entrepreneurs to get connected to the resources that we know are out there, and then try to connect Detroit small businesses with the millions of dollars being lended out by our local CDFIs.”

Sean Gray is Senior Vice President of Small Business Services at DEGC. He oversees all of their small business support programs, managing federal, state, municipal and philanthropic funds efficiently. With over 20 years experience working in the industry, he understands the unique benefits of working with CFDIs.

“We all saw and heard a lot about the need from the business owners,” Gray says. “Business owners don’t always have that kind of longstanding relationship with lenders. The CDFI lenders are mostly people who really deeply understand the underwriting process, and have a lot of value for their borrowers but also for the rest of the ecosystem. This gives us a way to direct borrowers into a relationship or a conversation with a CDFI in a way where they’re registering what type of capital they think they need.”

The platform is powered by LoanWell, a national technology company, who has used this model in other regions of the country.

Eligible businesses in the City of Detroit can utilize the Hub for competitive loan amounts from $1,000 to $250,000. These funds can then be used for equipment, payroll, utilities and rent, marketing and advertising, owner-occupied real estate and other expenses.

“We want to make sure that people understand and are aware of CDFIs because not only are they a great way to access affordable capital, but also really valuable technical assistance as well,” Gray says.

For Onwenu, he hopes the Detroit Capital Hub platform can help shine a light on the impactful work done within the Detroit CDFI ecosystem.

“I hope, longterm, this platform allows us to start making the case more holistically about the greater support that CDFIs need across all levels of government,” he says. “Having this data could be really helpful in demonstrating all the great work that’s already happening, and what even more support could mean for the ecosystem and for small businesses in Detroit.”

For Gray, he hopes Detroit Capital Hub can highlight support services that uplift, but not stifle or micromanage an entrepreneur’s ability.

“Detroit business owners are really uniquely autonomous,” he says. “They are people who take a lot of pride in what they create. There are elements of that autonomy that are about pride in Detroit, pride in your family, pride in your community and also being able to be un-bossed as a person of color, a woman, or another minority group. For me, I’m always looking for opportunities to not have resources or support trapped inside a brand. I’m trying to make sure that we surface the work we do in ways that are beneficial to people who maybe aren’t constituents of existing programs, but who can highlight new opportunities for us to serve, new inventive ways for us to include them in the story of support we’re trying to bring to Detroit businesses. We want to lift up their story so we can share the story of Detroit and its resurgence.”

Gerald Harris is an engineer and a Detroit entrepreneur. He recently utilized the Detroit Capital Hub tool, seeking capital for his business, aGiftaVerse Apparel, and was matched with ProsperUs Detroit.

aGiftaVerse Apparel is a customized apparel company which launched in April 2020. The business began with customized high school bomber jackets at 35 different schools in the surrounding area.

“Then I bridged out from there by starting a couple stores inside the high schools, and started a financial literacy program with the students as a way to give back,” Harris says.

After two years as a brick and mortar, the store transitioned to a more streamlined, online-only model. Now, the company creates and sells both ready-to-wear merchandise for the City of Detroit and local sports teams, as well as customized jackets for high school students, clubs, organizations and Wayne State University.

Harris attributes some of that growth to regional CDFIs including ProsperUs. They’ve helped walk the entrepreneur through applying for a business loan, helping build business credit, and enroll in a few courses.

He says the process has been extremely fast-moving, and integral to the next chapter of his business.

“It started at the beginning of November, and I was funded by Christmas,” he says. “The goal was to get access to capital to invest, buy more merchandise and potentially more equipment. Working with ProsperUs has been very good. They are very hands-on, calling and communicating every step of the way. They have been a great resource.”

Harris considers the Detroit Capital Hub as a hidden jewel or a golden nugget that everybody can utilize to really tap into resources and help for their business.

“It seems like everybody wants to start, but they don’t know where to start. I think the Detroit Capital Hub is that ideal place,” he says. “I’m a native Detroiter who moved away and then came back — really depending on my entrepreneurial business. Detroit Capital Hub and ProsperUs really just took me to the next level, so I appreciate them both.”

Paul Jones, CEO of ProsperUs Detroit is proud to be a part of Harris’ and other Detroit entrepreneurs’ success stories.

“Talent, grit, and innovation are abundant throughout our communities, but resources, especially access to capital, are not,” says Jones. “That is why we are deeply grateful to the City of Detroit, the Detroit Economic Growth Corporation, the Gilbert Family Foundation and Ally Foundation for launching the Detroit Capital Hub, and making it easier for entrepreneurs to find the right support. ProsperUs is proud to be part of this effort, and to have closed our first loan through the platform, helping connect a Detroit entrepreneur to the capital needed to grow their business and strengthen vibrant communities.”